The Securities and Exchange Commission (SEC) 18f-4 Derivatives Rule went into effect on August 19, 2022, setting new regulatory framework for derivative use.

How we can help?

- A turnkey SEC reporting package for compliance teams and boards

- Risk deep-dive tool for derivatives risk managers

- Intraday pre-trade what-if analysis tool for portfolio management and risk teams

Who needs to comply?

SEC-registered investment companies including*:

40 Act funds (mutual funds)

Exchange-traded funds (leveraged and inverse)

Business development companies (BDC)

*Exception for funds that have derivatives exposure to less than 10% of its net assets. In addition, derivatives used to hedge currency and interest rate risks are excluded from the derivatives exposure calculation.

Schedule a Free Consultation

Why Axioma Risk?

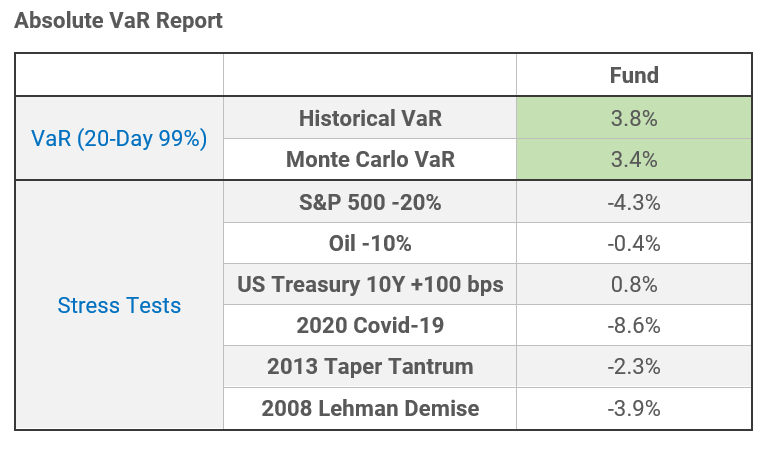

Turnkey reporting

Access our turnkey reporting package coupled with expert reporting solutions team at your service.

View Sample Outputs >

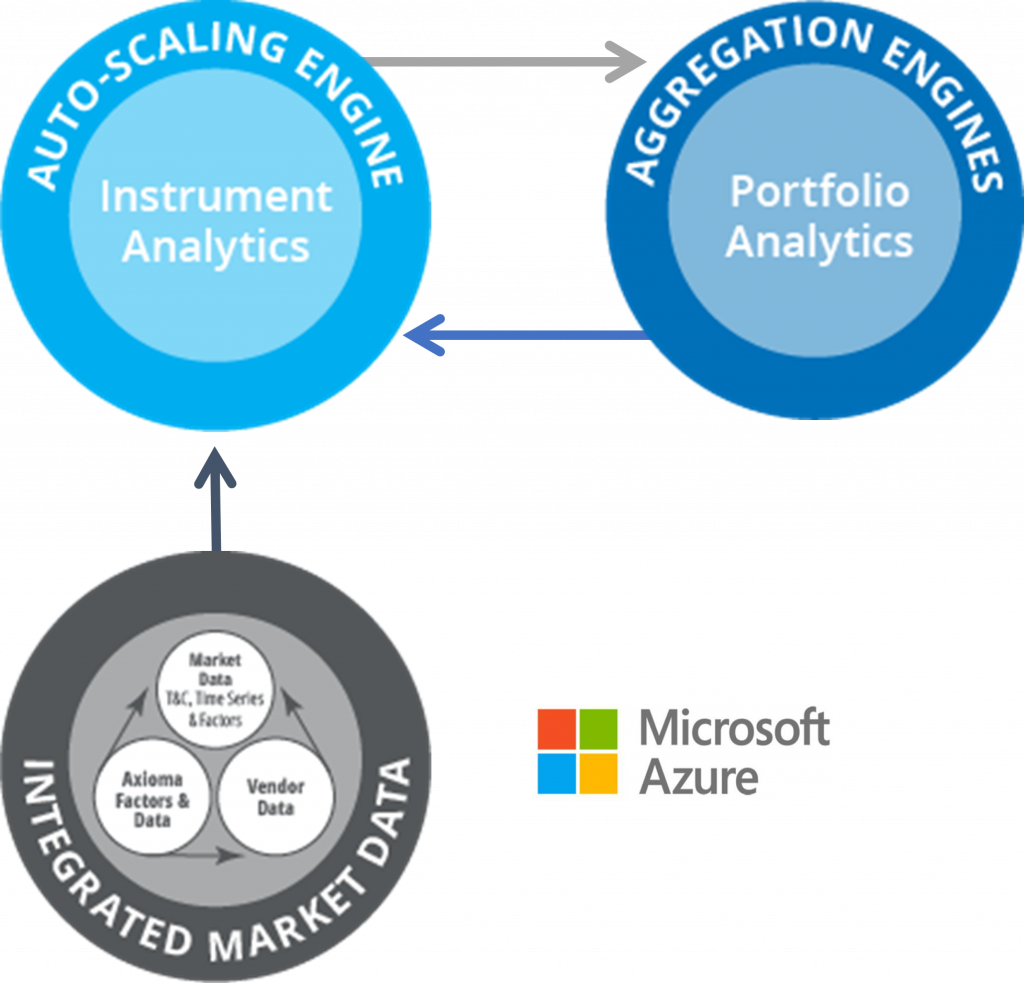

Cloud-native computing for scalability and performance

Access to tens of thousands of cores on Microsoft Azure that enables clients to run VaR calculations and backtests accurately and efficiently. Separating the aggregation and calculation engines allows users to make changes to their portfolio on the fly and obtain updated results at speed.

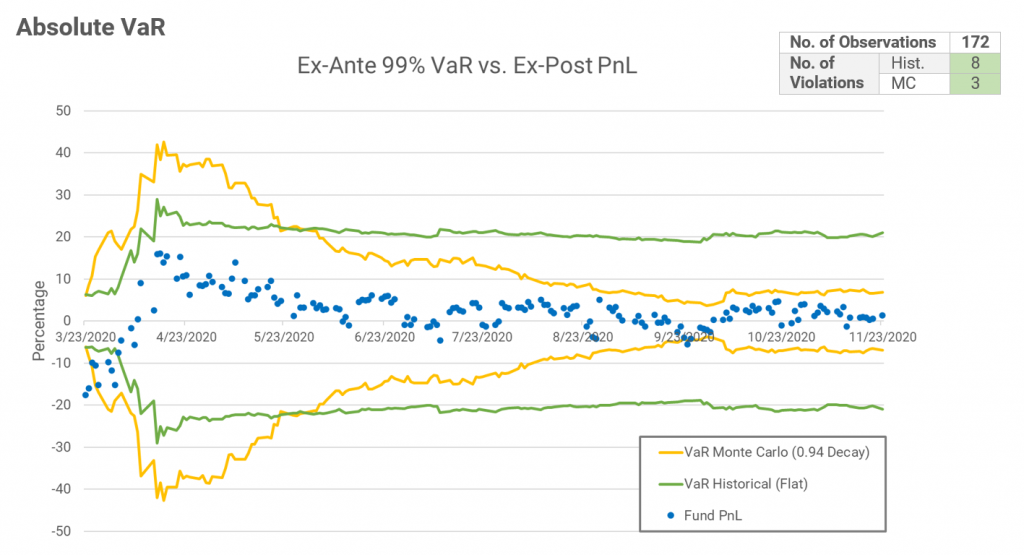

Accurate Results

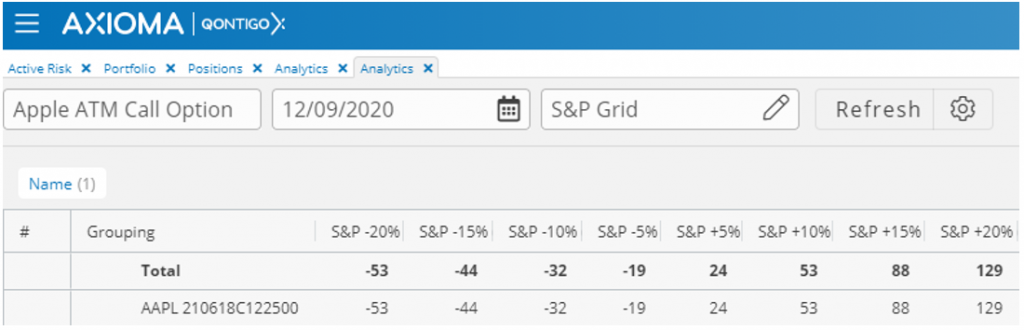

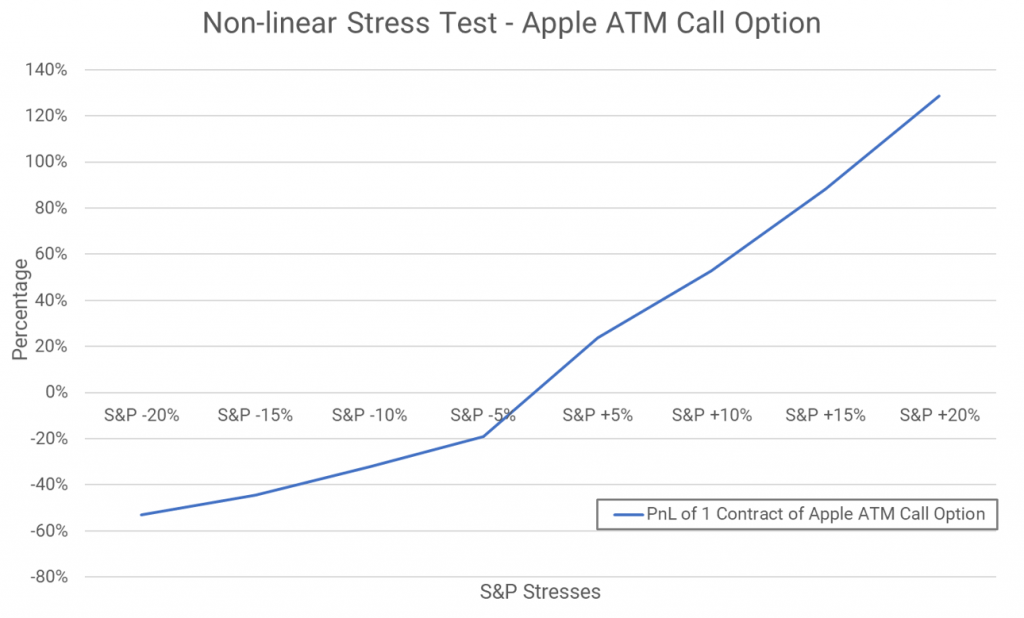

Be confident in the accuracy of results for derivatives and non-linear assets with full repricing.

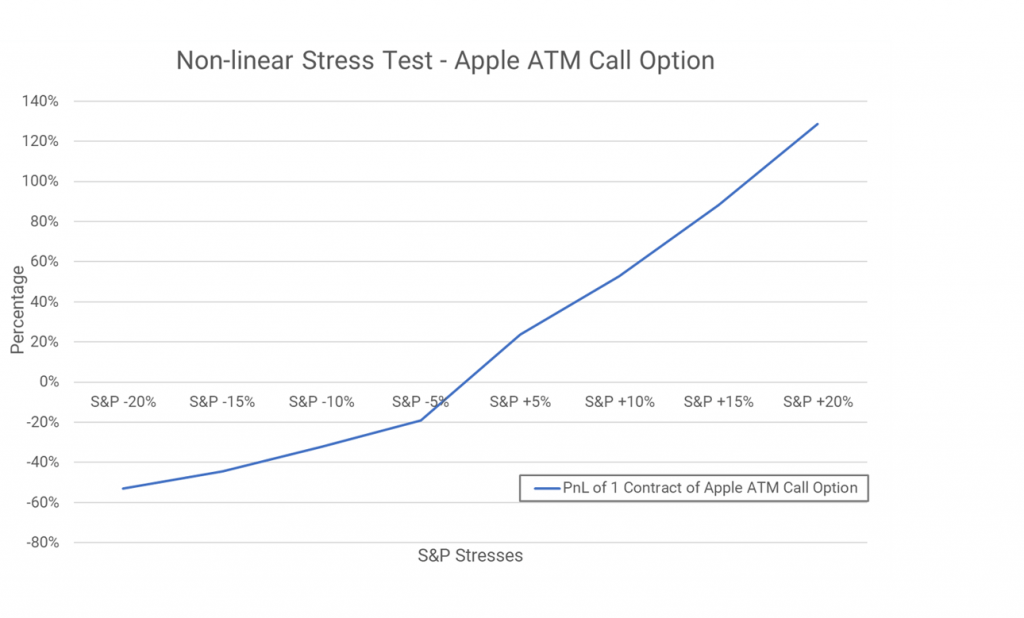

See an example of AAPL Call Option showing non-linear behavior in stress conditions due to the full-repricing approach.

Explore the Results >Schedule a no-commitment demo to learn more about our 18f-4 Rule offering.

Contact Us >Integrated market data and broad asset coverage

- Native pricing models for cash securities and derivatives are available across all markets and all asset classes.

- Benchmark data is also available in both constituent and time series forms.

- Best-of-breed pricing data, market data, historical time series, as-of-date Terms & Conditions data, and proprietary curves can be accessed natively.

Axioma Risk

Learn more about our flexible system for multi-asset

class risk management, offering analytics and data

in a unified platform.